Crypto Exchange Volume Vs OTC Volume

Crypto Exchange Volume

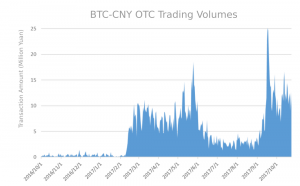

Cryptocurrency OTC volume is larger than exchange-traded volume in general. In the past, the cryptocurrency exchanges have been accused of artificially inflating their disclosed volumes. Miners and hedge funds are the primary buyers and sellers. The OTC desks at crypto exchanges are essentially buyers and sellers. In contrast, the exchanges themselves act as sellers. The average price per trade on the crypto exchanges varies from one day to the next.

Decentralized OTC crypto exchange

Bitcoin trading volume measures the total amount of Bitcoins purchased and sold on a particular exchange. High volume is an indicator of increased interest in the cryptocurrency market. Moreover, high trading volume can indicate a potential big price jump. However, the displayed volume is just from a small number of exchanges. The actual trading volume is much higher, as part of it is made on the OTC market.

There are two ways to measure volume for cryptocurrencies. The first method involves the number of trades per day on a particular crypto exchange. The second method is to use aggregated data from many exchanges. While publicly traded volumes provide a good representation of the overall activity of a crypto asset, they may not be the complete picture. Similarly, large amounts of coin activity are also traded over the Counter (OTC) market.

Crypto Exchange Volume Vs OTC Volume

While it is important to follow volume on exchanges, it is not as important as the OTC volume. OTC traders and institutional investors will likely trade on OTC markets because of the privacy and low-volume trading conditions. Consequently, the volume of the crypto OTC market is two to three times larger than the volume on official exchanges. It is therefore essential to monitor both to gain insight into the true market performance of the cryptocurrency.

OTC volume differs from the volume on cryptocurrency exchanges. It is the volume of trading on a specific crypto exchange. The OTC volume represents the total trading volume for a particular crypto. The OTC volume is an indicator of price movement. If the trading volumes are higher, the market is more liquid. If the volumes are lower, the market is more volatile. It is essential to understand how OTC works in order to avoid misunderstandings.

Besides being more transparent, OTC volume also means more privacy. In the OTC market, the exchanges are required to collect transaction fees from their clients. Because of this, crypto exchanges are more profitable than their OTC counterparts. They also have a smaller footprint compared to the OTC market. The OTC volume can be more volatile, so it is important to monitor both.